Last time, we covered some great reasons for taking the plunge with mobile payment. Now,

we’ll fill you in on several of the mobile payment options

out there.

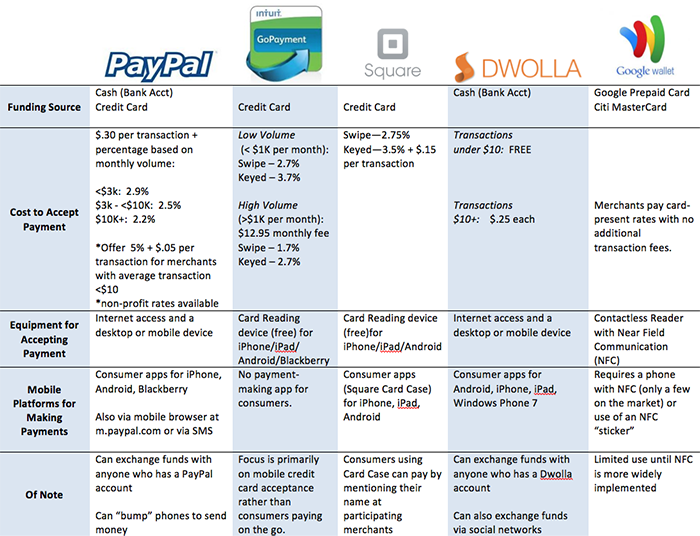

All of these services accomplish the goal of making and/or accepting payments on the go. However, cost and features vary, so let's do some comparison. First,

we'll outline some of the basic elements of these services.

Now, just a bit more detail on each:

Paypalis one of the most recognizable names in web payment given its connection to eBay. As you can see above, its PayPal Mobile service continues to allow individuals and businesses to exchange payment utilizing cash or credit. There are some useful

features including “bumping” phones to exchange payment, snapping a photo of a check to make a deposit, and “split the bill” capabilities. On the payment acceptance end of the deal, you’re going to pay $.30 per transaction,

plus a percentage based on volume.

Intuit GoPayment is primarily focused on providing an easy way to accept credit card payment from any location. They provide a

free card reader that can be plugged into the mobile devices listed above, and take a percentage of every credit card transaction. You can use the service without the free reader (entering card numbers manually), but you’ll pay more per transaction.

Square is similar to Intuit in that it provides a free card reading device that makes accepting credit cards simple wherever you may be.

In addition, they’ve also implemented a mobile app for individuals to use on the payment-making side. Users can store credit card data in their Square Card Case account and easily make payments at participating merchants.

Dwolla is a cash-only payment service born of its founder’s frustration with the burden of credit card fees for small business. Dwolla is

building a loyal consumer following with its timely David vs. Goliath image. Merchants see the marketing advantage of its built-in social sharing features. But, what’s the ultimate advantage for merchants?

Accepting payment via the Dwolla

network is cheaper than any other service. Transactions of $10 and up (and we mean up—there’s no limit) are $.25. Under $10, they’re free (a recent change). Shifting the consumer credit card mindset in a new direction presents challenges,

but Dwolla has generated national coverage lately—

here,

here,

and

here, for example. And, they’re making a big announcement on December 15. We’ll be paying attention.

Google Wallet has a giant name behind it but, unfortunately, not the infrastructure (yet) to make it a viable option for everyone.

It utilizes

Near Field Communication (NFC) which is only available on a few mobile devices. Merchants also need a contactless card reader that uses NFC technology.

Hopefully this rundown will help you make an informed decision when it comes to your mobile payment options.

In the spirit of full disclosure, Far Reach worked with Dwolla earlier this year on the development of their Android mobile

app, and we just released an update of the Windows Phone 7 app. However, we’ve also recommended other mobile payment services to our clients based on their needs. Which one makes the most sense for you?